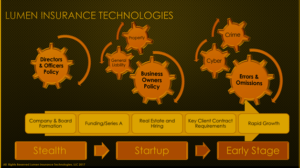

The content is primarily meant to be helpful to busy entrepreneurs in the tech community as it pertains to insurance. We post helpful content with a little humor. Go ahead and give it a read…

In the world of commercial insurance, policyholders often find themselves navigating through complex documents filled with industry jargon and technical terms. The majority of startups don’t read their insurance policies.

As spring arrives, it’s not just our homes that could benefit from a thorough cleaning – it’s also an

opportune time for business owners to tidy up their commercial insurance programs.

Lumen’s CEO spoke with Andrew Correll, host of Insurance Requireents podcast about all startup founders need to know about insuring their startup.